Explore the pivotal roles of FIIs, DIIs, HNIs, RIIs, and Depositories in the Indian stock market. Discover how global indices, including Dow Jones, S&P 500, and more, influence investment decisions. Get insights into opening hours and the impact on your investments in this comprehensive guide.

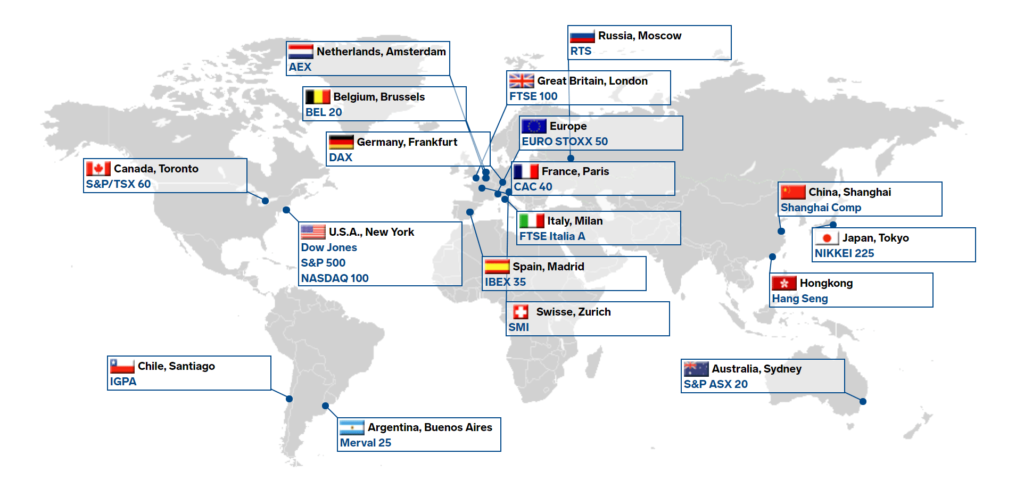

Introduction: In the dynamic world of finance, several key players significantly influence the Indian stock market. These players include Foreign Institutional Investors (FIIs), Domestic Institutional Investors (DIIs), High Net Worth Individuals (HNIs), Retail Individual Investors (RIIs), and the pivotal role played by Depositories. Additionally, the performance of various global indices, including those from Germany, France, and Hong Kong, has a substantial impact on the Indian stock market. In this SEO-optimized article, we will delve into who these entities are, their roles, and explore how these global indices influence the Indian stock market. We will also provide information on the opening hours of these indices in Indian time.

Understanding FIIs, DIIs, HNIs, RIIs, and Depositories:

Foreign Institutional Investors (FIIs): FIIs are foreign entities, such as mutual funds, pension funds, and hedge funds, that invest in the Indian stock market. Their investments have a substantial impact on market liquidity and sentiment.

Domestic Institutional Investors (DIIs): DIIs comprise domestic entities like mutual funds, insurance companies, and banks that invest in the Indian stock market. They contribute to market stability by providing consistent funds.

High Net Worth Individuals (HNIs): HNIs are affluent individuals with significant financial resources who invest in Indian stocks directly and through financial instruments. Their investment decisions can influence market movements.

Retail Individual Investors (RIIs): RIIs encompass individual investors who participate in the stock market. While each RII may invest relatively small amounts, their collective investments significantly impact market activities.

Depositories: India’s two primary depositories are the National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL). They are responsible for holding securities in electronic form, enhancing trading and settlement efficiency and security.

Global Indices and Their Impact on the Indian Stock Market:

Dow Jones Industrial Average (DJIA): The DJIA is a leading U.S. stock market index. Positive performance in the DJIA can enhance investor confidence in global markets, indirectly influencing Indian stocks positively.

S&P 500: The S&P 500 represents 500 large U.S. companies. Its performance can impact global investment decisions, indirectly affecting the Indian stock market.

Nikkei 225: Japan’s Nikkei 225 is crucial for Asian markets, including India. A strong Nikkei implies a bullish sentiment in Indian equities.

FTSE 100: The FTSE 100 represents the UK stock market and is closely monitored by Indian investors interested in international markets.

Shanghai Composite: China’s stock market, as represented by the Shanghai Composite, holds significant sway over Asian markets, including India.

Germany – DAX (Deutscher Aktienindex): The DAX is the primary stock index in Germany, comprising the 30 largest and most liquid companies listed on the Frankfurt Stock Exchange. A strong DAX can signal a robust European economy, positively influencing foreign investment in the Indian stock market.

France – CAC 40 (Cotation Assistée en Continu): The CAC 40 is the benchmark stock market index of France, representing the performance of the 40 most significant companies listed on Euronext Paris. Changes in the CAC 40 can impact investor sentiment in India and influence foreign investment decisions.

Hong Kong – Hang Seng Index: The Hang Seng Index is a leading stock market index in Hong Kong, tracking the performance of the largest and most liquid companies listed on the Hong Kong Stock Exchange. It is a crucial indicator of the Asian financial market and can influence investor sentiment and fund flows into the Indian stock market.

Know about the Indian Indices: Understanding India’s Stock Market Indices: Nifty 50, Nifty Bank, Nifty Sensex, and More

Also Read : Nifty 50 Companies and How the Nifty Index Is Calculated

The Impact of Global Indices on the Indian Stock Market: Changes in these world indices can affect foreign investment decisions in Indian stocks. Positive international market performance can attract more FIIs and boost market sentiment, while a global economic downturn can lead to fund withdrawals, causing market declines.

See global markets live: https://www.moneycontrol.com/markets/global-indices/

Opening Hours of World Indices in Indian Time:

Dow Jones (DJIA): Opens at 7:00 PM Indian Time and closes at 1:30 AM.

S&P 500: Opens at 7:00 PM Indian Time and closes at 1:30 AM.

Nikkei 225: Opens at 5:30 AM Indian Time and closes at 11:30 AM.

FTSE 100: Opens at 1:30 PM Indian Time and closes at 10:30 PM.

Shanghai Composite: Opens at 7:30 AM Indian Time and closes at 12:30 PM.

DAX (Germany): Opens at 1:30 PM Indian Time and closes at 7:00 PM.

CAC 40 (France): Opens at 2:30 PM Indian Time and closes at 7:30 PM.

Hang Seng Index (Hong Kong): Opens at 6:30 AM Indian Time and closes at 1:30 PM.

Conclusion: Understanding the roles of FIIs, DIIs, HNIs, RIIs, depositories, and the impact of various global indices is essential for investors. These indices reflect the economic health and investment climate in their respective regions, indirectly influencing the Indian stock market. Stay informed and use this knowledge to make well-informed investment decisions in the Indian stock market.

Know What is an IPO?: IPO : A Beginner’s Guide to Initial Public Offerings

FAQs

1: What are FIIs, and how do they impact the Indian stock market?

Answer: Foreign Institutional Investors (FIIs) are foreign entities like mutual funds, pension funds, and hedge funds that invest in the Indian stock market. They impact the market by influencing liquidity and sentiment.

2: What role do DIIs play in the Indian stock market?

Answer: Domestic Institutional Investors (DIIs) include domestic entities like mutual funds and insurance companies. They contribute to market stability by providing consistent funds and investments.

3: How can High Net Worth Individuals (HNIs) influence the Indian stock market?

Answer: HNIs are affluent individuals with significant financial resources who invest in Indian stocks directly and through financial instruments. Their investment decisions can influence market movements.

4: How do global indices, such as the Dow Jones and S&P 500, impact the Indian stock market?

Answer: Global indices serve as indicators of global market sentiment. Positive performances in these indices can enhance investor confidence, indirectly influencing Indian stocks positively.

5: Why are depositories important in the Indian stock market, and what is their role?

Answer: Depositories like NSDL and CDSL hold securities in electronic form, enhancing trading and settlement efficiency and security. They play a crucial role in safeguarding the integrity of the Indian stock market.