In the world of the stock market, traders employ various strategies to navigate the uncertainties and mitigate risks. Two prominent techniques that have gained traction are hedging and scalping. In this comprehensive guide, we delve into the intricacies of these strategies, exploring their definitions, purposes, and how they can be effectively employed in the stock market.

Hedging

Hedging is a risk management strategy aimed at minimizing potential losses in the face of adverse market movements. Essentially, it involves taking on an offsetting position to an existing investment, creating a safeguard against market fluctuations. Traders often use financial instruments such as options, futures, or derivatives to hedge their portfolios.

Types of Hedging

Options Hedging: Investors can use put options to protect their portfolios against potential downside risks. A put option gives the holder the right to sell a security at a predetermined price, providing a safety net in case of market downturns.

Futures Hedging: This involves using futures contracts to lock in future prices, safeguarding against adverse price movements. Futures contracts enable traders to buy or sell an asset at a predetermined price on a specified future date.

Diversification: Hedging can also be achieved through diversifying the portfolio. By holding a mix of assets with different risk profiles, investors can spread risk and minimize the impact of adverse market movements.

Benefits of Hedging

Risk Mitigation: The primary benefit of hedging is the reduction of potential losses during market downturns.

Portfolio Stability: Hedging strategies contribute to portfolio stability, ensuring a more consistent performance over time.

Improved Decision-Making: Traders can make more informed decisions by considering the potential risks and rewards associated with hedging strategies.

Mastering Stock Market Fundamentals: Bearish and Bullish Trends, Gap-Up/Gap-Down Openings, and More

Understanding India’s Stock Market Indices: Nifty 50, Nifty Bank, Nifty Sensex, and More

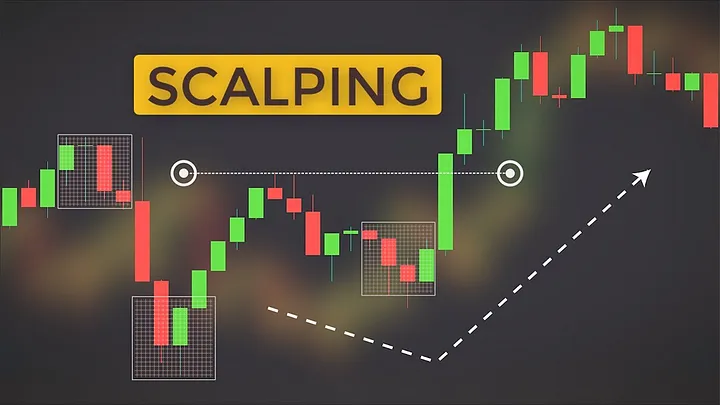

Scalping

Scalping, on the other hand, is a short-term trading strategy focused on exploiting minor price fluctuations. Scalpers aim to make small profits from numerous trades executed throughout the day. This strategy relies on quick decision-making, tight spreads, and the use of leverage to magnify profits from minimal price movements.

Key Characteristics of Scalping

Short Holding Periods: Scalpers typically hold positions for a few seconds to a few minutes, capitalizing on short-term market inefficiencies.

High Frequency: Scalpers execute a large number of trades in a single day, aiming to accumulate small gains that add up over time.

Technical Analysis: Scalping relies heavily on technical analysis, with traders using charts, indicators, and real-time market data to make rapid decisions.

Benefits of Scalping

Quick Profits: Scalping allows traders to generate profits quickly, capitalizing on small price changes.

Reduced Exposure: Since positions are held for short durations, scalping minimizes exposure to overnight risks associated with market fluctuations.

Adaptability: Scalping can be applied to various market conditions, making it adaptable to different trading environments.

Trade the live markets moneycontrol.com/

In the intricate landscape of the stock market, understanding and implementing hedging and scalping strategies can empower traders to navigate uncertainties and optimize their trading performance. While hedging provides a shield against potential losses, scalping thrives on seizing fleeting market opportunities. By incorporating these strategies into their toolkit, traders can develop a well-rounded approach to managing risk and maximizing profits in the dynamic world of stocks.

1 thought on “What is hedging & scalping?”